How shipping ton-miles can fall at the same time spot rates spike

Ocean shipping demand is traditionally measured in “ton-miles”: volumes multiplied by distance. So, here’s a paradox: Ton-miles for liquefied natural gas shipping have fallen in 2022, because most cargoes from the U.S. are being pulled to war-stricken Europe instead of going longer-haul to Asia. And yet, LNG shipping spot rates have skyrocketed to Guinness Book levels of up to $500,000 per day.

How is this possible?

This paradox was addressed at the Marine Money New York Ship Finance Forum on Thursday. The answer — which offers an important lesson on understanding demand in all shipping segments, from tankers to bulkers to container ships — is that it’s not all about ton-miles.

Ton-days not ton-miles

There are two reasons why LNG shipping spot rates have gone through the roof despite falling ton-miles: the effect of time or “ton-days” (volume multiplied by voyage time) and the effect commodity pricing on ship availability.

Jefferson Clarke, head of LNG commercial analytics at Poten & Partners, said at the Marine Money event, “When we forecast shipping supply-demand balances, it’s not actually just about ton-miles. While that’s an important element, we also focus on the impact of time.”

Brokerage BRS highlighted this issue in a dry bulk shipping report earlier this year. “For the uninitiated, freight demand is often perceived to be the absolute amount of cargo loaded and shipped. A shipping professional … knows that a shipment that traveled across half the globe is going to generate more demand for freight capacity [i.e., ton-miles].”

But “while ton-miles have been widely used in the shipping industry, one hidden flaw is that it doesn’t take into account waiting time,” wrote BRS. “Hence, it will be instructive to [reexamine] freight demand using ton-days.”

The runup in rates for larger dry bulk ships in 2021 was heavily driven by Chinese port delays that boosted ton-days. Surging container-ship freight rates from Asia to the West Coast in late 2021 were partly driven by unloading delays in Los Angeles/Long Beach. The boom in very large crude carrier (VLCC) rates in spring 2020 was driven by floating storage, vastly extending the time between loading and discharge.

That same dynamic is now playing out in LNG shipping.

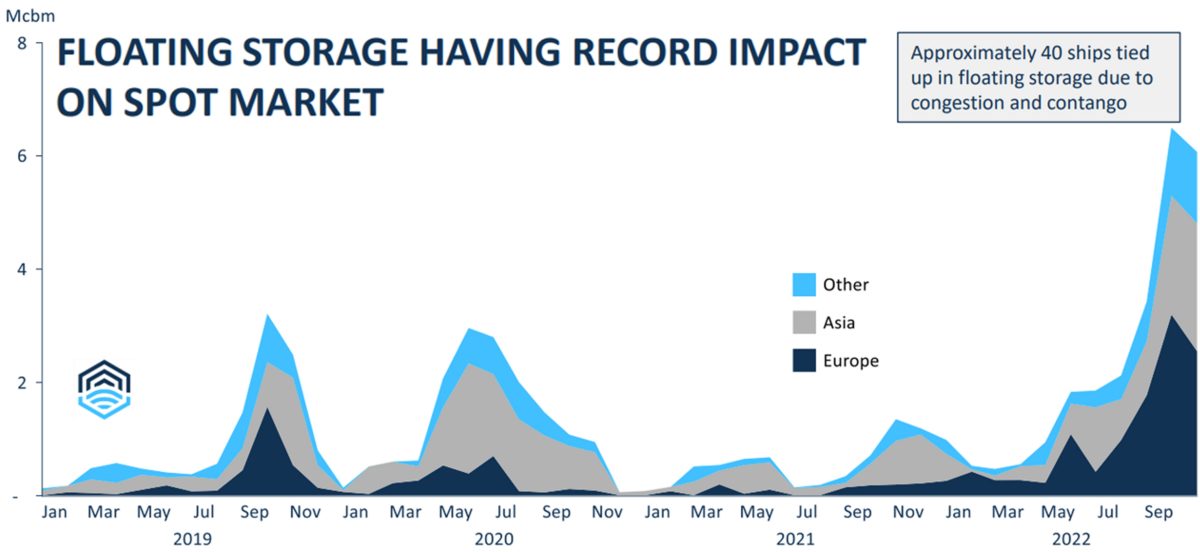

Flex LNG (NYSE: FLNG) CEO Oystein Kalleklev said on a quarterly call last Tuesday, “There is a huge buildup of [LNG] ships tied up in floating storage, especially in Europe but also in other countries. As of today, we are at an all-time high level of around 40 ships being tied up in floating storage, which is taking out a lot of ships from the general freight market, which is making the freight market very tight.”

Looming insurance ban on Russian crude

This same ton-days factor is expected to be a key positive crude-tanker spot rate driver when the EU and U.K. ban on shipping insurance for Russian crude exports comes into effect in two weeks.

Higher voyage distance — ton-miles — will be the largest factor, but not the only factor.

Contango and ton-days

Spot shipping rates are driven by commodity prices in at least two ways. First, related to ton-days, if the forward commodity price is high enough versus the current price (known as contango) to induce floating storage. Second, if the arbitrage profits — the price difference between one region and another — are exceptionally high.

The contango in crude pricing caused the VLCC rate spike in spring 2020, increasing ton-days. LNG prices in Europe are in contango now.

Kalleklev said at the Marine Money forum, “Not only do we have all this congestion in Europe, but there is a glut of LNG coming into Europe, pushing prompt prices lower, meaning you get this big contango. Suddenly, there are two incentives for floating storage, congestion and contango, so rates have skyrocketed.”

Commodity price effect on charter markets

The second commodity-price factor — arbitrage profits between regions — seems even more important to today’s LNG spot rates, due to its effect on the long-term charter market.

In any spot shipping market, the rate depends on how many vessels are actually available for spot business. LNG ships available for short-term employment are now virtually nonexistent because they’re all on long-term charters and those charterers are generally not subletting their vessels into the spot trade.

According to Clarke, “In the current environment, LNG [commodity] prices are more a determining factor on shipping demand.”

Clarke explained: “Charterers are holding onto tonnage and not subletting their vessels out. They are more concerned about having access to tonnage. They’re more focused on the [long] term market than the spot market. So, when we read these headlines of high [spot] rates, they’re largely irrelevant, because there’s very little liquidity.”

In other words, LNG ship charterers can make more money by pocketing arbitrage profits moving their own cargoes than from briefly subletting their vessels to others. Because there are so few ships left for spot trading, LNG spot shipping rates have risen to $450,000 to $500,000 a day due to lack of tonnage — but very few vessel owners actually earn those rates.

“It’s not really a market,” said Kalleklev of the current spot LNG shipping business.

Parallel in container-ship leasing

This extreme emphasis on long-term charters does not occur in dry bulk and oil tanker trades, because ownership is highly fragmented, many owners keep a substantial portion of their fleets on spot even in boom times, and tankers are bulkers are largely in “tramp” trades (i.e., no fixed port pairs).

In 2021 and the first half of 2022, container-ship owners chose to lease out tonnage on historically lucrative multiyear deals. Liners agreed to pay exceptionally high rates for extended durations. Virtually every ship available for lease was leased out.

As in LNG shipping, container-ship owners opted for long-term deals over short-term ones even though short-term rates were much higher, because a bird in the hand is worth more than two in the bush. Meanwhile, liners did not sublet the ships they chartered, because they could earn much more using the chartered ship to transport containerized cargo than they could from sublet income.

This severely limited container-ship tonnage available for short-term, multi-month charters, causing short-term leasing rates for a very small number of vessels to spike to $200,000 per day.

Add it all up and the takeaways are: For LNG shipping and container-ship leasing, focus on long-term rates, not the short-term rates that get the headlines, and for all shipping markets, think less about ton-miles and more about ton-days, which encompass not only voyage length but also loading and unloading delays.